A ratio of less than 1 means the business would need to use other short-term assets, such as its receivables, to fully pay out its current liabilities. You’ll also find that a company’s balance sheet generally reports its current or short-term liabilities separately from its long-term liabilities, making them easy to identify. You can find the amounts of cash and cash equivalents held by an organization on its balance sheet.

Debt service coverage ratio

A good coverage ratio indicates that it's likely the company will be able to make all its future interest payments and meet all its financial obligations. The actual figure that constitutes a good coverage ratio varies from industry to industry. The cash coverage ratio is a financial metric that measures a company’s ability to pay its interest expenses using the cash generated from its operating activities, without relying on external financing.

Cash Equivalents

If this ratio is more than 1, the company is in a comfortable position to repay the loan. Coverage ratios are used to measure the ability of your company to pay financial obligations. These obligations can include interest expense payments or all debt obligations, including the repayment of principal and interest. They want to see if a company maintains adequate cash balances to pay off all of their current debts as they come due. Creditors also like the fact that inventory and accounts receivable are left out of the equation because both of these accounts are not guaranteed to be available for debt servicing. Inventory could take months or years to sell and receivables could take weeks to collect.

What is Cash Flow Coverage Ratio?

Conversely, the cash coverage ratio measures cash against all current liabilities, not just interest expense. The Cash Coverage Ratio is an indispensable tool in financial analysis, offering insights into a company’s ability to meet its interest obligations through operational earnings. Investors, creditors, and corporate managers alike benefit from understanding and applying this ratio to make informed decisions. The Cash Coverage Ratio is a financial metric that evaluates a company’s ability to cover its interest expenses using its EBITDA. Simply put, this ratio measures how much of the company's earnings are available to pay interest on its outstanding debt.

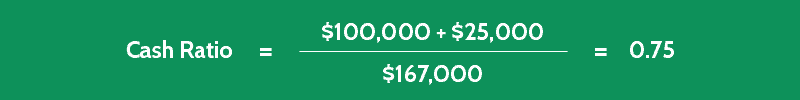

As you can see from the results of this calculation, Company C’s current cash reserve is about 0.75, or 75% of its current liabilities. This is an all-in-one guide on how to calculate Cash Coverage ratio with detailed interpretation, analysis, and example. You will learn how to use its formula to evaluate a company's liquidity.

- Only cash and cash equivalents are included in the cash coverage ratio.

- It is an important indicator of a company’s liquidity, solvency, and overall financial health.

- This approach enables comparisons of an entity’s current year financials with its past year performance, competitors’ current year performance, or the overall performance of the sector or industry.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- Furthermore, it also dictates the terms lenders will imply on their loans.

- It may be advantageous for a company to reduce its cash ratio in these cases.

Why You Can Trust Finance Strategists

In this example, Company Z has a cash coverage ratio of 5.83, which indicates that it has more than enough cash flow from its operating activities to cover its interest expenses. This suggests that Company Z is in a strong financial position to meet its debt obligations without relying on external financing. The ultimate purpose of a current cash debt coverage ratio involves identifying whether or not the company can cover its debt with the current operating cash flow generation.

Even though the company is generating a positive cash flow, it looks riskier from a debt perspective once debt-service coverage is taken into account. A ratio of one or above is indicative that a company generates sufficient earnings to completely cover its debt obligations. My business partner and I were looking to purchase a retail shopping center in southern California. Ronny found us several commercial properties which met our desired needs.

Our Resource Center provides extensive coverage of the financial ratios that you frequently encounter in commercial real estate. For example, see Debt Yield — Everything Investors Need to Know and Cap Rate Simplified (+ Calculator). For instance, check out our articles on Hard vs Soft Money Loans and Preferred Equity — Everything Investors Need to Know. In other words, it has enough money to pay off 75% of its current debts.

Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. The owner would have to liquidate other assets to pay all her bills on time. Predictably, within months the unit cost definition restaurant goes bankrupt and closes its doors forever. Now, you must find a new tenant to lease the space, and you’ll probably absorb vacancy costs. Conveniently, you can view this video to step through the calculation.

Liquidity is a measurement of a company's ability to pay its current liabilities. A company with high liquidity can pay its short-term bills as they come due. It's going to have a more difficult time paying short-term bills if it has low liquidity. The cash ratio is seldom used in financial reporting or by analysts in the fundamental analysis of a company.